INSCOIN

Insurance is one of the oldest industries, and can be seen as part of the growth of modern business that has come to define the world-wide society. While the insurance in the form we will recognize today begins with the first insurance contract in 1347, methods for transferring and distributing risks in the monetary economy have been observed in China in the third millennium BC. One thing that has defined the insurance sector for thousands of years is its ability to adapt its practices to fit the changing technological landscape. From contracts written on parchment to websites and large data, the industry has changed rapidly.

Blockchain is the latest technology game changer to include images, and many predict that distributed ledgers can have profound effects on how insurance companies can operate. One important issue that seems to be designed by blockchain technology is the underlying principle of 'good faith' in insurance contracts. This principle states that any party entering into an insurance contract has a legal obligation to act with a standard of "greater honesty than is normally required in most commercial contracts." This means that insurance companies are required to believe that they are being told the truth by the person want to take out insurance.It's different from other contracts, which are usually based on the principle of 'let the buyer beware.

Applying a blockchain to this problem means that insurance contracts and consumer personal data can be stored on a distributed ledger, with consumers controlling who has access. The data remains on the user's personal device and this can eliminate the need for brokers and other intermediaries that appear as mediators between insurance companies and consumers. Blockchain not only offers the promise of cost reduction and efficiency, but also can enable revenue growth, as insurance companies attract new business through high quality services.

Blockchain technology can help the wholesale insurance sector fulfill its role in supporting the global economy more effectively. Just as blockchain is being pursued as a force for positive change in other areas of society - from identification to refugees to better public services - it can also help wholesale insurance to carry out its responsibilities for the common good.

The KNOX Project will be the first insurance company to combine the real world with the digital world using Blockchain technology, creating the most efficient and sophisticated structure in the sector, to find solutions to certification and anti-counterfeit insurance policies. With smart contracts, the spread of fake insurance policies is avoided because it is the same system that issues them upon receipt of payment. With smart contracts, the company will not have any delay in collecting credits, since the policy is issued only after receiving payment. This factor aims to improve the company's management significantly. With a smart contract in the event of an accident, the actual judge who will decide whether or not to pay them is no longer a company, which can have opportunistic behavior, but the blockchain system, in absolutely no interest in human opinion, will decide whether the accident is appropriate with provisions in the policy. This benefit will be the most important because it will increase the company's transparency to customers.

With smart contracts, the spread of fake insurance policies is avoided because it is the same system that issues them upon receipt of payment. With a smart contract the company will not have any delay in the collection of credit, since the policy is issued only after receiving payment. This factor aims to improve the company's management significantly.

With smart contracts in the event of an accident, real judges who will decide whether or not to pay them are no longer a company, which could have opportunistic behavior, but a blockchain system that, in absolutely no interest in human opinion, will decide whether the accident is in accordance with provisions in the policy. This benefit will be the most important because it will increase the company's transparency to customers.

INSCOIN => This is the crypto currency that will be used for each activity or transaction at https://www.inscoin.co/ Insurance Company.

Token Token TOKEN =>

Type of the token INSC => ERC20 (network Ethereum) Common token

There is a total stock of 500 000 000INSC

FOR SALE TOKEN => Total

270 000 000INSC, allocated for sale of tokens

Exchange rate => The current will be extinguished with a value of 1ETH = 5000INSC.

Soft cover = for this project there is an excellent project 4TH ETH soft cap.

Hard cap => Hard-cap 39,444 ETH, while the unsold token will be destroyed after the token sale period.

PRE-ICO => Pre-Ico for initial investors begins on June 23, 2018 and expires on July 7, 2018.

ICO => Ico begins on July 23, 2018 and ends on August 23, 2018, which is the exact period of 1 month.

There is an additional bonus that stands out for every stage of the ICO, which is a good development for investors

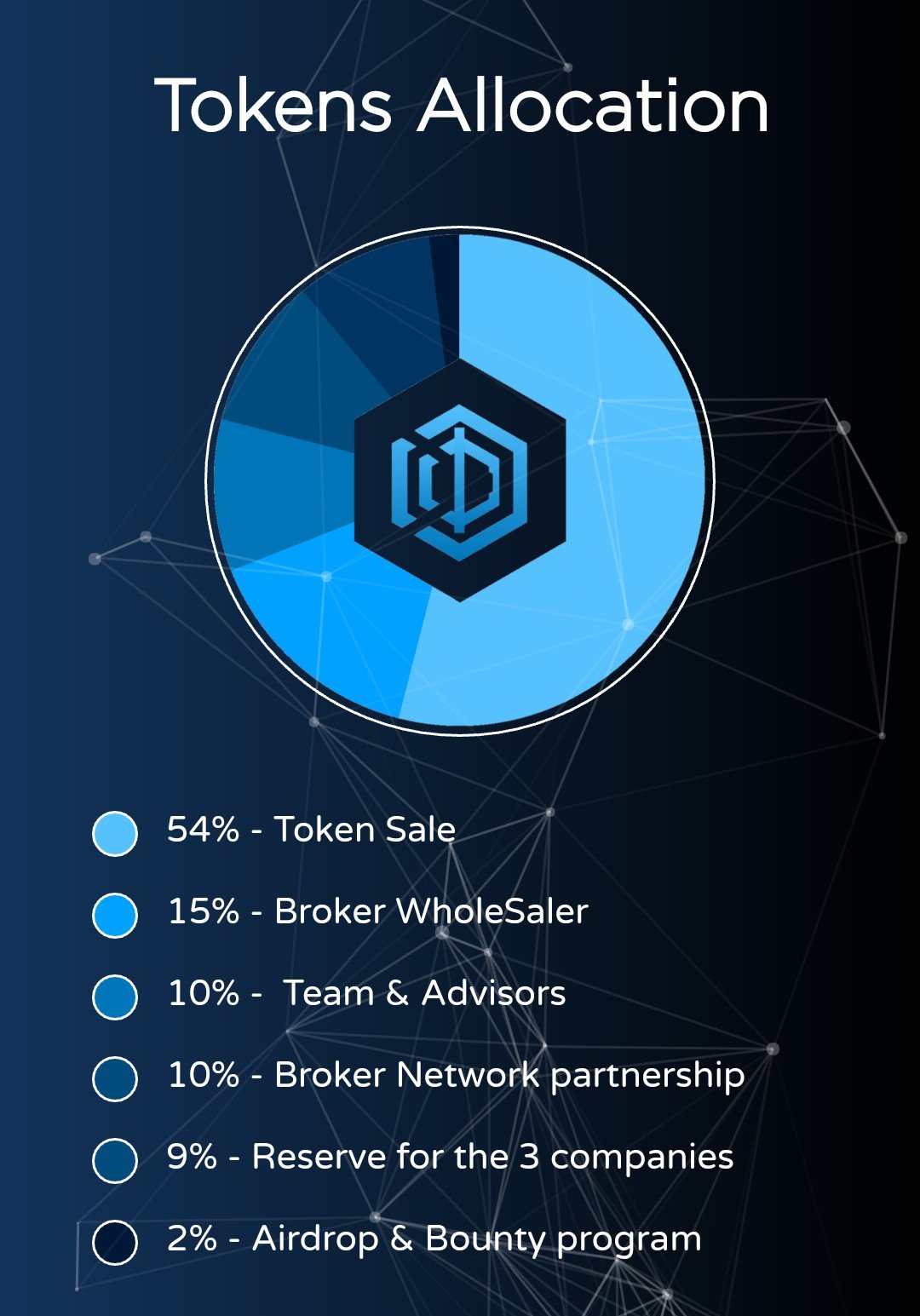

CURRENT DISTRIBUTION

DISTRIBUTION OF FINANCING

ROADMAP

TEAM

FURTHER INFORMATION

Website: https://www.inscoin.co/

Whitepaper: https://inscoin.co/assets/content/whitepaper_en.pdf

Telegram: https://t.me/inscoinico

Linkedin: https://www.linkedin.com/company/inscoin-holding-ou/

Twitter: https://twitter.com/inscoinforknox

Facebook: https://www.facebook.com/Inscoin-for-Knox-1802470656458272/

Reddit: https: //www.reddit

My profile: https://bitcointalk.org/index.php?action=profile;u=2071847

Tidak ada komentar:

Posting Komentar