Introduction

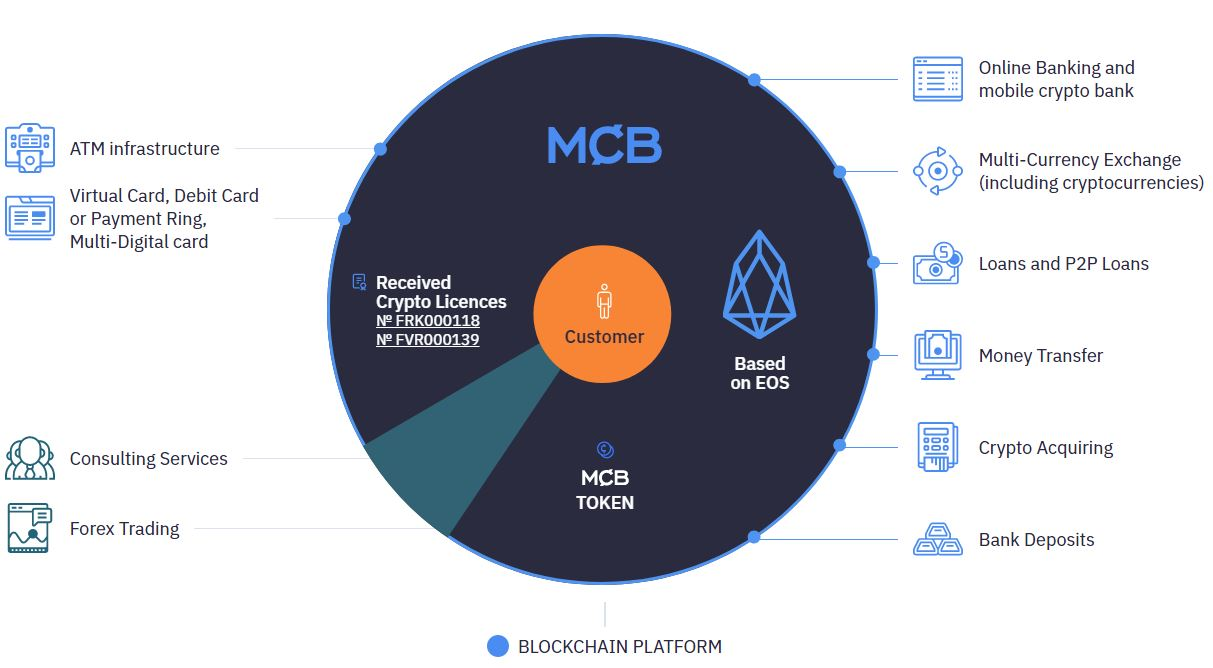

MyCryptoBank is an online bank that allows any customer registered in the electronic banking system to perform a full range of banking operations, additional operations with crypto-currencies (payment processing, debit cards, loans and cheap investment products, the use of cryptanalysis as a credit security and many others) based on Blockchain technology without visiting the department. Thus, MyCryptoBank provides remote access services to customers for accounts, products and banking services for banking operations.

MyCryptoBank offers its customers a multifunctional platform for banking services, which is a hybrid system that combines digital and traditional currencies. The use of digital currencies makes operations faster and cheaper, while traditional currencies guarantee almost full acceptance and validity. One combination of accounts allows customers to simultaneously take advantage of both types of currencies.

Why MyCryptoBank?

Now, in the FinTech area, there are many block-start-ups, the idea of crypto banks has been investigated many times by different teams, some of them already execute their own ICO.

At the same time, attempts to create it always become unrealized to the end, we can say that now no crypto business is fully functioning in the world.

Most of these projects failed at the stage of obtaining a banking license to work with the crypto currency in the euro area and the US - the choice of these countries was due to any desire to demonstrate their reliability to customers. However, local regulators do not provide banks with any licenses to work with crypto-currencies.

We follow the rules in MyCryptoBank and, unlike most of the competitors, we share our processes of obtaining a banking license and a license for working with crypto-currencies, which leads us legally to work both with money and with crypto-converters.

On May 7, 2018, a company that is a member of a financial holding company that implements the MyCryptoBank project received licenses in Estonia for turnover and maintaining a virtual value:

The provider of the virtual currency exchange service in monetary currency No. FVR000139;

Comparative analysis of MyCryptoBank with other cryptobanks:

Possibility to create smart contracts and decentralized applications (DAPPs): MCB token is a smart contract, used in various bank applications. Each of the applications is a decentralized one, composed of 2 basic parts — the smart contract and the user interface (UI), simplifying the communication procedure between the user and the contract.

Scalability: Client base of some banks contain millions of users, requiring possible fast scale.

Cost of transactions: If clients are requested to pay the additional blockchain network fee, it will set back the bank development and the client database growth. Thus, the blockchain platform with the close to zero cost of transactions should be chosen for implementation.

Updateability of smart contracts and applications (DAPPS): Bank products and software should keep up with the times and develop continuously, which requires possible on hand update of the software code and security patch with no hard fork.

Parallel tasking: Many bank applications make huge computations, thus there is need of parallel computing to speed up the applications.

Time of transaction confirmation: Minimum time for the transaction to get sufficient number of confirmations and to become irreversible.

Interoperability with different blockchain architectures: Possible interoperation with different blockchain assets — an important feature, required for banking solutions configuration, supporting the multicurrency service.

MCB token is issued on the EOS platform, being at present the only platform, complying with all listed criteria. EOS is based on DPOS algorithm consensus (Delegated Proof Of Stake) and Byzantine fault tolerance modification. The present algorithm consensus assures low cost of transactions, high application execution speed and has already proved to be reliable in such networks as Bitshares and Steem. Additionally, EOS supports possible internetwork communication (Inter Blockchain Communication), facilitating development of multicurrency banking applications.

Ecosystem

Bank card and payment rings;

Exchange of crypto-currencies / crypto-currencies, cryptocurrency / fiat;

Money transfers around the world;

Financing and loans P2P;

Getting the crypto currency;

Crypto-ATM and cryptosystem;

Deposit interest;

Forex trading;

Consulting and legal services, including taxes;

Token:

MCB Platform: EOS

Token Price: 0.2 USD

Tokens for sale: 517,075,000 MCB (65%)

Token supply: 795,500,000 MCB

Investment info

Soft stamp: 3,000,000 USD

Hard cap: 100,000,000 USD

Receive: ETH, BTC, LTC, FIAT, BCH, EOS

Limited country: United States

Get to know your Customers: Yes

Whitelist: None

Pre-Sales Starting 2 days, 5 hours from now

Pre-Sales 07/16/2018 midnight - 08/16/2018 midnight

Sale Token 09/10/2018 midnight - 10/14/2018 midnight

Token Distribution

Token Allocation

Roadmap

FURTHER INFORMATION

Whitepaper: https://mycryptobank.io/docs/MyCryptoBank-white-paper.pdf

Telegram: https://t.me/MyCryptoBank

Facebook: https://web.facebook.com/Mycryptobank?_rdc=1&_rdr

Twitter: https://twitter.com/MyCryptoBank

Reddit: https://www.reddit.com/user/MyCryptoBank

My profile: https://bitcointalk.org/index.php?action=profile;u=2071847

Tidak ada komentar:

Posting Komentar